Effective Personal Finance Management in India 2023: Tips on Budgeting, Investing, Life & Health Insurance and More

Managing personal finance in India in 2023 requires a careful consideration of both macroeconomic and microeconomic factors. Here are some tips to help you manage your personal finances effectively in 2023:

1. Start by creating a budget:

"A budget is telling your money where to go instead of wondering where it went." - Dave Ramsey

A budget is a crucial tool that helps you track your expenses and identify areas where you can cut costs. Make sure to include all your sources of income and expenses, including fixed and variable expenses. Stick to your budget as much as possible to ensure you're spending within your means.

2. Save and invest:

"The stock market is a device for transferring money from the impatient to the patient." - Warren Buffett

With inflation likely to remain high in 2023, it's important to save and invest wisely. Consider investing in assets such as stocks, mutual funds, or real estate that have a potential for high returns. However, it's important to keep in mind the risks associated with each investment option and consult a financial advisor before making any investment decisions.

3. Keep an eye on interest rates:

As of March 11, 2023, Reserve Bank of India (RBI) Repo Rate is 4.00% and RBI Reverse Repo Rate is 3.35%.

Interest rates can have a significant impact on your personal finances, especially if you have loans or investments. In 2023, interest rates are likely to remain high, so make sure to keep an eye on them and take advantage of any opportunities to refinance or invest in high-interest savings accounts or fixed deposits.

4. Be mindful of taxes: With the government likely to continue implementing tax reforms in 2023, it's important to stay informed and plan your finances accordingly. Make sure to take advantage of tax deductions and exemptions, and consult a tax professional if you're unsure about any tax-related matters.

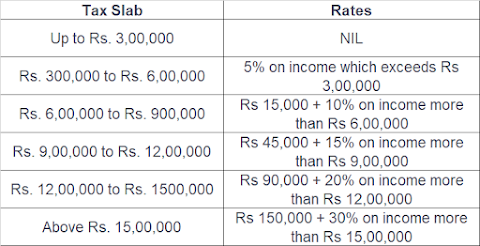

Income Tax Slab for FY 2023-24 (AY 2024-25)

The following tables show the Revised Income Tax Slabs and not the old tax regime. The table for the new tax regime slabs-

Income Tax Slab for People Between 60 to 80 Years

5. Build an emergency fund:

"A rainy day fund isn't just smart, it's essential. Without one, a single setback can wipe out your financial security." - Suze Orman

Given the uncertain economic environment, it's important to have an emergency fund that can help you weather any financial shocks. Aim to save at least 3-6 months' worth of living expenses in an easily accessible savings account or liquid fund. This can be saved up to 12 months. The allocation of emergency fund can be fixed as follows.

6. Avoid debt: With interest rates likely to remain high in 2023, it's important to avoid taking on unnecessary debt. If you do have existing debts, focus on paying them off as quickly as possible to avoid paying high interest charges.

- Financial Protection: Life insurance ensures that your loved ones are financially secure in case of your untimely death. It can help cover expenses like funeral costs, outstanding debts, and other financial obligations.

- Income Replacement: Life insurance can provide a steady stream of income to your family if you were to pass away. This can help replace your lost income and ensure that your family can continue to maintain their standard of living.

- Inflation Protection: Life insurance benefits can be adjusted for inflation to ensure that they are still sufficient to cover future expenses.

- Estate Planning: Life insurance can be used as a tool for estate planning to help ensure that your assets are distributed according to your wishes.

- Peace of Mind: Having life insurance can provide peace of mind, knowing that your loved ones are protected financially in case of your sudden death.

- Rising Healthcare Costs: Healthcare costs continue to rise, and having health insurance can help individuals and families to manage the financial burden of medical expenses.

- Access to Quality Healthcare: With health insurance, individuals have access to quality healthcare services, including preventive care, diagnostic tests, and treatments for medical conditions.

- Protection against Catastrophic Events: Health insurance can provide protection against catastrophic events, such as a serious illness or injury, that can result in high medical bills.

- Tax Benefits: In many countries, including the United States, premiums paid for health insurance are tax-deductible, providing additional financial benefits to individuals and families.

- Employer Benefits: Many employers offer health insurance benefits as part of their employee benefits package, making it easier and more affordable for individuals to obtain coverage.

- Peace of Mind: Having health insurance can provide peace of mind, knowing that individuals and their families are protected against the financial impact of unexpected medical expenses.

By following these tips and staying informed about the latest economic developments in India, you can manage your personal finances effectively in 2023.

.png)

Comments

Post a Comment